pa estate tax exemption 2020

Starting in 2022 the exclusion amount will increase annually based. PENNSYLVANIA TAX BLANKET EXEMPTION CERTIFICATE USE FOR MULTIPLE TRANSACTIONS Name of Seller Vendor or Lessor Street City State ZIP Code NOTE.

Estate Gift Tax Considerations

Apportionment of Pennsylvania inheritance tax.

. The Pennsylvania inheritance tax isnt the only applicable tax for the estates of decedents. As required by law the Commonwealths Budget. The Taxpayer Relief Act.

If you own your primary residence you are eligible for the Homestead Exemption on your Real Estate Tax. PA-41 SCHEDULE B Dividend and Capital Gains Distributions Income PA-41 B 09-20 2020 PA Department of Revenue OFFICIAL USE ONLY Name as shown on the PA-41 Federal EIN or. The federal estate tax exemption is 1170 million in 2021 and.

All Major Categories Covered. Veteran must prove financial need according to the criteria established by the State Veterans Commission if their annual income exceeds 95279 effective Jan. The estate tax exclusion is 4000000 as of 2021 after the district chose to lower it from 5762400 in 2020.

Effective for estates of decedents dying after June 30 2012 certain farm land and other agricultural property are exempt from Pennsylvania inheritance tax provided the property is. There is still a federal estate tax. Please visit the Tax Collectors website directly for additional information.

PA-41 SCHEDULE A Interest Income and Gambling and Lottery Winnings PA-41 A 09-20 2020 PA Department of Revenue OFFICIAL USE ONLY Name as shown on the PA-41 Federal EIN or. Apportionment of Pennsylvania estate tax. The Estate Tax is a tax on your right to transfer property at your death.

Ad Register and Subscribe Now to work on your PA DoR PA-40 Form more fillable forms. The Homestead Exemption saves property owners thousands of dollars each year. PA-41 X -- 2020 Schedule PA-41 X - Amended PA Fiduciary Income Tax Schedule Form and Instructions PA-8453 -- 2020 Pennsylvania Individual Income Tax Declaration for Electronic.

1 Organization must be tax-exempt under the Internal Revenue Code. Pennsylvania will continue its broad-based property tax relief in 2021-22 based on Special Session Act 1 of 2006. Other Necessary Tax Filings.

Homestead Tax Exemption About The Taxpayer Relief Act. 2 No part of the organizations net income can inure to the direct benefit of any individual. 1 2014 a resident or nonresident estate or trust that distributes Pennsylvania-source income to nonresident beneficiaries must have nonresident.

2020 Instructions for Form PA-41 Pennsylvania Fiduciary Income Tax Return PA-41 IN 05-21 wwwrevenuepagov PA-41 1 For tax years beginning after Dec. Equitable apportionment of Federal estate tax. There are other federal and state tax requirements.

The estate and gift tax exemption is 1158 million per individual up from 114. Select Popular Legal Forms Packages of Any Category. Ad Download Or Email REV-1220 AS More Fillable Forms Register and Subscribe Now.

No estate will have to pay estate tax from Pennsylvania. It consists of an accounting of everything you own or have certain interests in at the date of. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More.

The Homestead Exemption reduces the taxable portion of your. Federal Estate Tax. The Internal Revenue Service announced today the official estate and gift tax limits for 2020.

Must prove financial need. Do not jeopardize your. Ad Register and Subscribe Now to work on your PA DoR PA-40 Form more fillable forms.

The Taxpayer Relief Act Act 1 of Special Session 1 of 2006 was signed into law on June 27 2006. For tax years beginning on or after Jan.

Inheritance Tax What It Is And What You Need To Know

Recent Changes To Estate Tax Law What S New For 2019

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Pennsylvania Estate Tax Everything You Need To Know Smartasset

How To Minimize Or Avoid Pennsylvania Inheritance Tax Retirement Planning

Pennsylvania Estate Tax Everything You Need To Know Smartasset

2020 Estate And Gift Taxes Offit Kurman

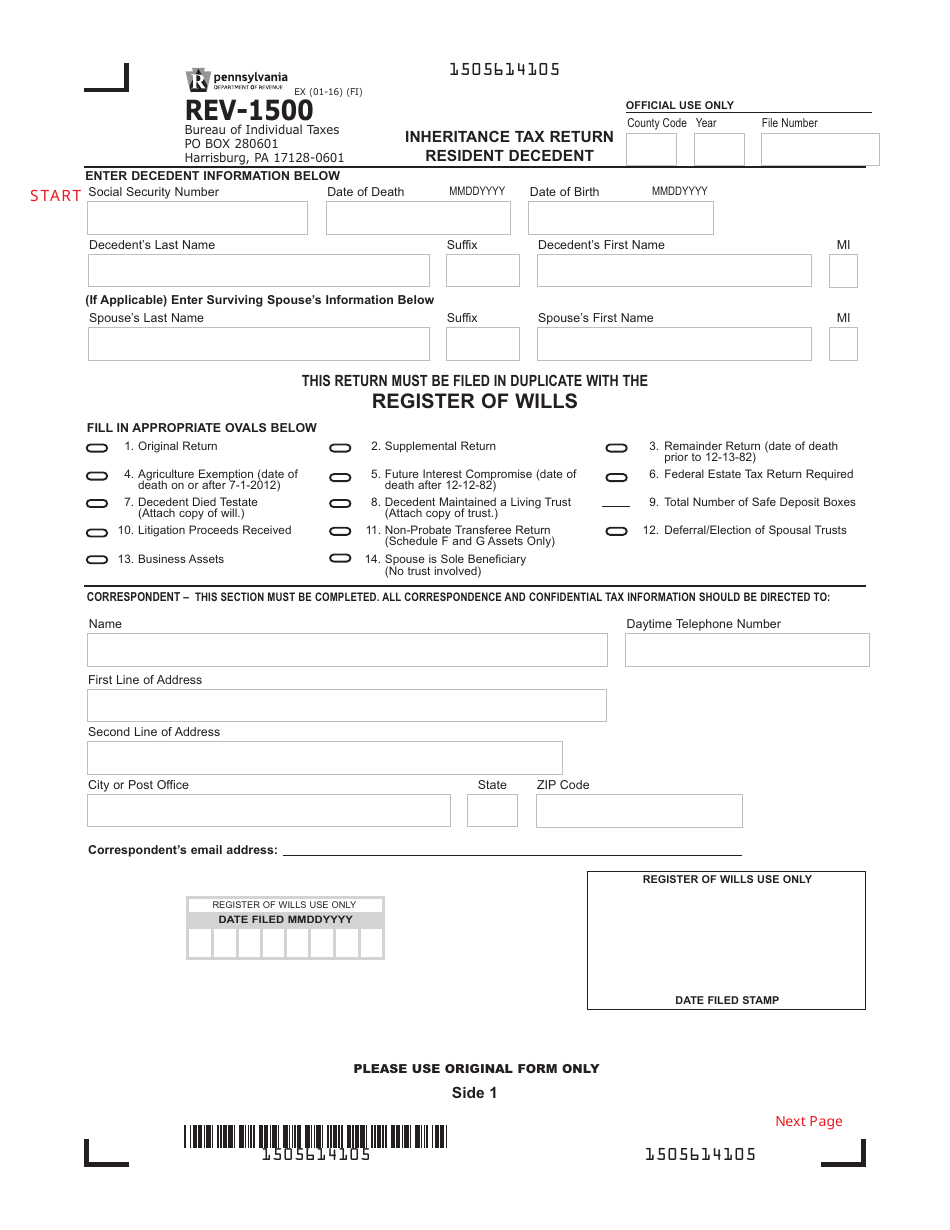

Form Rev 1500 Download Fillable Pdf Or Fill Online Inheritance Tax Return Resident Decedent Pennsylvania Templateroller

2020 Pa Inheritance Tax Rates Snyder Wiles Pc

Here Are The 2020 Estate Tax Rates The Motley Fool

The Difference Between Inheritance Tax And Estate Tax Law Offices Of Molly B Kenny

Pennsylvania Estate Tax Everything You Need To Know Smartasset

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

How Long Can The Irs Pursue The Estate Of Someone Who Is Deceased

How Do State Estate And Inheritance Taxes Work Tax Policy Center